Collective Mining Drills 180.6 Metres Grading 2.43 g/t Gold Equivalent in the Newly Discovered Main Breccia at the Apollo Target

- APC-3 intersected a broad, high-grade zone of breccia mineralization with multiple, overprinting carbonate base metal veins beginning at 200 metres below surface and returned:

- 180.6 metres @ 2.43 g/t gold equivalent.

- APC-5 also intersected the main breccia structure with some overprinting carbonate base metal veining beginning at 135 metres below surface and yielded:

- 268.00 metres @ 1.50 g/t gold equivalent.

- Three rigs continue to actively drill at Apollo with four additional completed holes awaiting assay results in the near term.

- APC-6 and APC-8 were designed to test the main breccia target at Apollo and both holes intersected more than 265 metres of potentially favourable mineralization.

- APC-4 and APC-7 were NOT designed to test the main breccia target but rather two grassroot concept targets at Apollo. Both holes intersected potentially favorable mineralization with APC-4 cutting a 10-20-metre-thick zone of carbonate base metal veins with visible gold observed in one vein and APC-7 cutting 3 mineralized zones of favorable angular breccia down-hole between 20-40 metres thick.

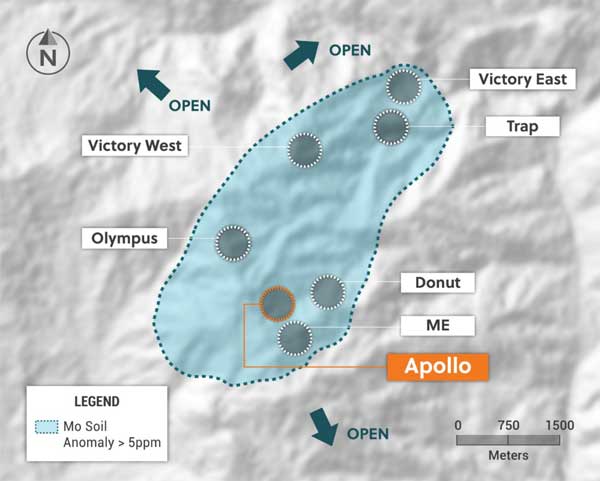

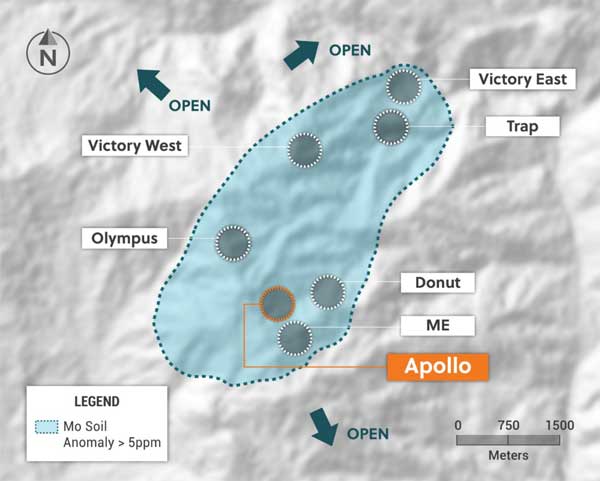

Toronto, Ontario, August 29, 2022 – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results from two additional holes completed at the Apollo target (“Apollo”) at the Company’s Guayabales project located in Caldas, Colombia. Apollo is a newly discovered high-grade copper-gold-silver porphyry-related breccia and is one of eight porphyry-related targets situated within a three-by-four-kilometre cluster area generated by the Company through grassroots exploration at the project. As part of its fully funded 20,000+ metre drill program for 2022, there are currently three diamond drill rigs operating at the Apollo target with an additional rig drilling from underground at the Olympus target.

“These latest drill intercepts demonstrate the remarkably continuous nature of this mineralized breccia and overprinting CBM vein system which is now expanding with every drill hole that we complete. With multiple overprinting events depositing mineralization into the system, the Apollo main breccia has all the right markers to evolve into a large-scale discovery. We will remain aggressive with drilling for the balance of 2022,” commented Ari Sussman, Executive Chairman.

A short video presented by David Reading discussing the results can be seen by clicking here.

Details (See Table 1 and Figures 1 – 4)

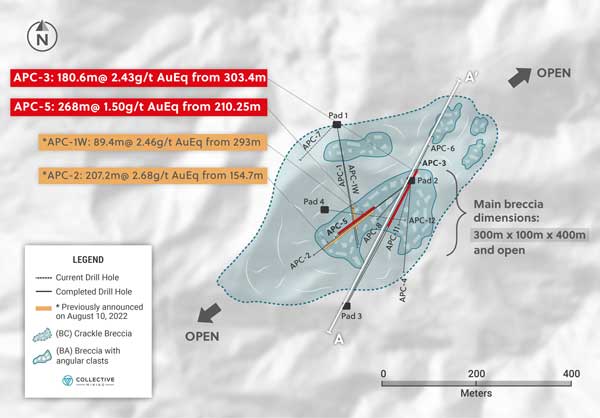

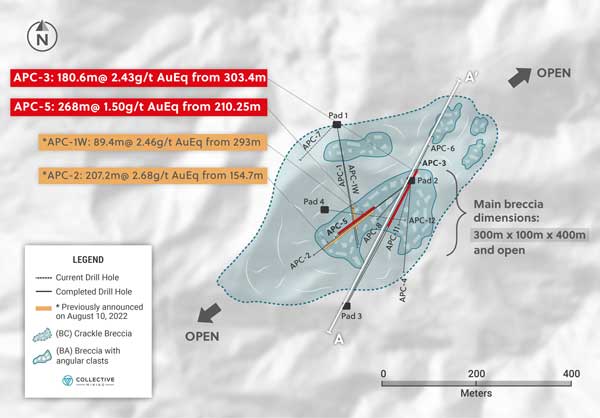

Five diamond drill holes with accompanying assay results have now been announced at Apollo and resulted in expansion of this main breccia and overprinting vein system with dimensions of up to 300 metres along strike by 100 metres across by 400 metres vertical. The target remains open in all directions and has the potential to evolve into a significant high-grade, bulk tonnage mineralized system.

Drill holes APC-3 and APC-5 were drilled in opposite directions from two separate drill pads (Pads 2 and 3) to the northeast and southwest respectively to test continuity of the mineralized breccia previously intersected in holes APC-1, APC-1W and APC-2 and to test the early working model of the geometry of the main breccia (see press releases dated April 27, 2022, June 22 and July 6, 2022). The following results are highlighted:

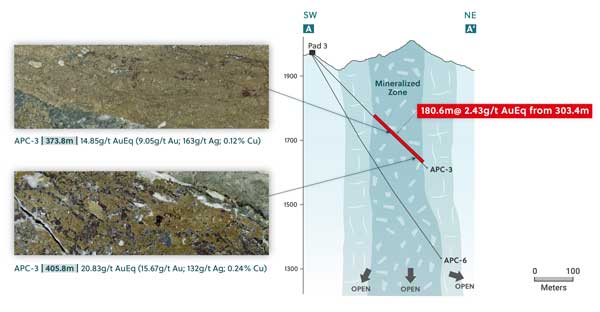

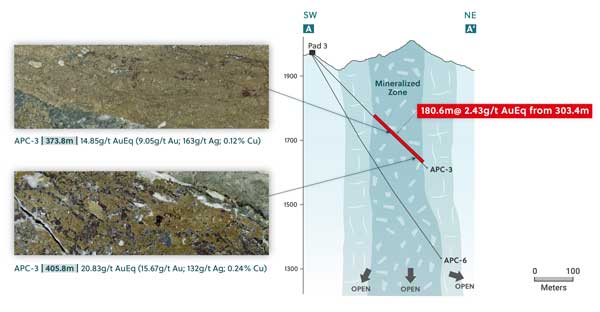

180.60 metres @ 2.43 g/t AuEq from 303.40 metres down hole (200 metres vertical) including:

21.10 metres @ 3.47g/t AuEq from 304.9 metres down hole, and

46.60 metres @ 5.13 g/t AuEq from 363.1 metres down hole.

APC-3 is the first hole drilled from a newly constructed pad (Pad 3) located approximately 400 metres to the south of Pad 1 (Holes APC-1 and 1W) and 300 metres to the southwest of Pad 2 (Hole APC-2 and APC-5).

268.00 metres @ 1.50 g/t AuEq from 210.5 metres down hole (135 metres vertical) including:

16.35 metres @ 2.55 g/t AuEq from 210.3 metres down hole,

19.20 metres @ 3.03 g/t AuEq from 252.6 metres down hole, and

22.25 metres @ 2.92 g/t AuEq from 456.6 metres down hole.

APC-5 was drilled from Pad 2 to the SW with a steeper inclination and a 200-metre vertical difference from the previous intercept reported in APC-2.

- Mineralization is remarkably continuous along the axis of both intercepts and is hosted within an angular breccia with a sulphide matrix consisting of chalcopyrite (Cu), pyrite and pyrrhotite. Additionally, overprinting carbonate base metal porphyry veins flood the breccia matrix in various locations along the mineralized interval yielding the higher-grade intercepts in both holes. The breccia clasts are all quartz diorite and diorite in composition and this hydrothermal system is clearly linked to a porphyry system.

- A further four holes (APC-4, APC-6, APC-7 and APC-8) have now been completed with APC-9, APC-10 and APC-11 now being drilled.

- APC-6 and APC-8 were designed to test the main breccia target at Apollo and both holes intersected more than 265 metres of potentially favourable mineralization.

- APC-4 and APC-7 were NOT designed to test the main breccia target but rather two grassroot concept targets at Apollo. Both holes intersected potentially favorable mineralization with APC-4 cutting a 10-20-metre-thick zone of carbonate base metal veins with visible gold observed in one vein and APC-7 cutting 3 mineralized zones of favorable angular breccia down-hole between 20-40 metres thick.

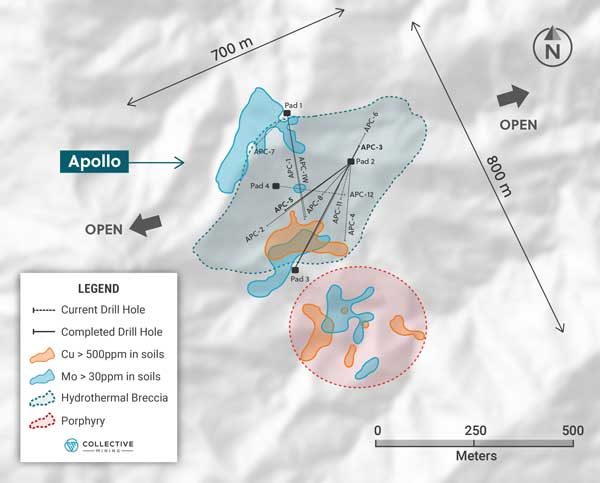

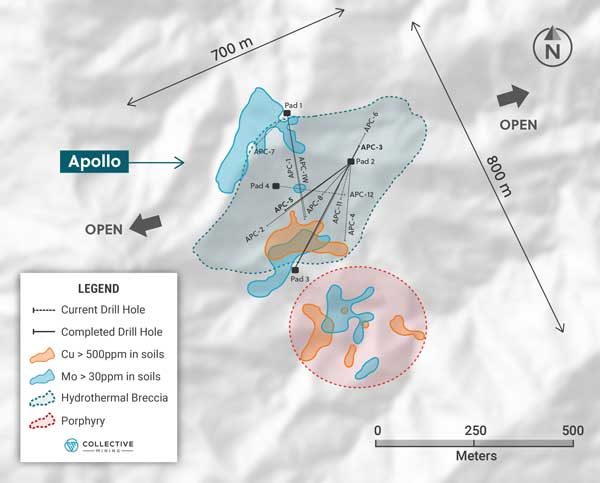

- The Apollo target area, as defined to date by surface mapping, rock sampling and copper and molybdenum soil geochemistry, covers an 800 metre X 700 metre area. The Apollo target area hosts the Company’s new grassroots main breccia discovery plus additional yet untested breccia, porphyry and vein targets. The Apollo target area also remains open for further expansion.

Table 1: Assays Results

| HoleID |

From

(m) |

To

(m) |

Intercept

(m) |

Au

(g/t) |

Ag

(g/t) |

Cu

% |

Zn

% |

Pb

% |

Mo

% |

AuEq

(g/t)* |

| APC-3 |

303.40 |

484.00 |

180.60 |

1.52 |

39 |

0.16 |

0.13 |

0.11 |

0.001 |

2.43 |

| Incl |

304.90 |

326.00 |

21.10 |

2.86 |

24 |

0.04 |

0.28 |

0.28 |

0.001 |

3.47 |

| |

363.10 |

409.70 |

46.60 |

3.78 |

58 |

0.20 |

0.33 |

0.27 |

0.001 |

5.13 |

| APC-5 |

210.25 |

478.25 |

268.00 |

0.89 |

22 |

0.13 |

0.11 |

0.07 |

0.002 |

1.50 |

| Incl |

210.25 |

226.60 |

16.35 |

1.95 |

20 |

0.04 |

0.308 |

0.23 |

0.001 |

2.55 |

| |

252.60 |

271.80 |

19.20 |

2.61 |

14 |

0.04 |

0.271 |

0.13 |

0.000 |

3.03 |

| |

456.00 |

478.25 |

22.25 |

2.30 |

21 |

0.04 |

0.332 |

0.24 |

0.002 |

2.92 |

| and |

496.80 |

510.65 |

13.85 |

0.71 |

9 |

0.02 |

0.144 |

0.11 |

0.001 |

1.00 |

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.014 x 0.95) + (Cu (%) x 1.96 x 0.95) + (Mo (%) x 7.35 x 0.95)+(Zn(%)x 0.86 x 0.95)+ (Pb(%)x 0.44 x 0.95) utilizing metal prices of Cu – US$4.00/lb, Mo – US$15.00/lb, Zn – US$1.75/lb, Pb – US$0.9/lb, Ag – $20/oz and Au – US$1,400/oz and recovery rates of 95% for Au, Ag, Cu, Mo, Zn and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.2 g/t AuEq cut-off grade was employed with no more than 15% internal dilution. True widths are unknown, and grades are uncut.

Figure 1: Plan View of the Guayabales Project Highlighting the Apollo Target

Figure 2: Plan View of the Apollo Target Area Outlining the Porphyry and Breccia Targets, their Related Soil Anomalies and Drill Holes Completed or Currently Underway

Figure 3: Plan View with Traces of drill holes completed to date in the Main Breccia Discovery at Apollo

Figure 4: Apollo Target Cross Section N-S with Core Photo Highlights for APC-5

Marketing Services Agreement

The Company is pleased to announce an agreement with Proven and Probable ("PP") to provide investor relations services to the Company, subject to approval by the TSX Venture Exchange (the "TSX-V"). PP will provide investor relations services to increase exposure to and awareness of Collective. Services include, but not limited to:

- Displaying Collective on its sponsor webpage.

- Conduct interviews with management and advisors and publish them on their website and other virtual channels.

- Publish third party media regarding Collective on their website and other virtual channels.

The agreement with PP has a term of one year, for which they will be paid an annual fee of USD $72,000. PP currently owns 3,250 common shares of Collective.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Collective Mining is an exploration and development company focused on identifying and exploring prospective mineral projects in South America. Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, the mission of the Company is to repeat its past success in Colombia by making significant new mineral discoveries and advance the projects to production. Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders.

The Company currently holds an option to earn up to a 100% interest in two projects located in Colombia. As a result of an aggressive exploration program on both the Guayabales and San Antonio projects, a total of eight major targets have been defined. The Company has made significant grassroot discoveries at both projects with near-surface discovery holes at the Guayabales project yielding 302 metres at 1.11 g/t AuEq at the Olympus target, 163 metres at 1.3 g/t AuEq at the Donut target and recently, at the Apollo target, 207.15 metres at 2.68 g/t AuEq, 89.4 metres at 2.46 g/t AuEg and 87.8 metres at 2.49 g/t AuEg. At the San Antonio project, the Company intersected, from surface, 710 metres at 0.53 AuEq. (See related press releases on our website for AuEq calculations)

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Contact Information

Collective Mining Ltd.

Steven Gold, Vice President, Corporate Development and Investor Relations

Tel. (416) 648-4065

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.