Phase 1 Completed in 2021 – Advanced surface work progressing

Initial Discovery Announced: October 27, 2021

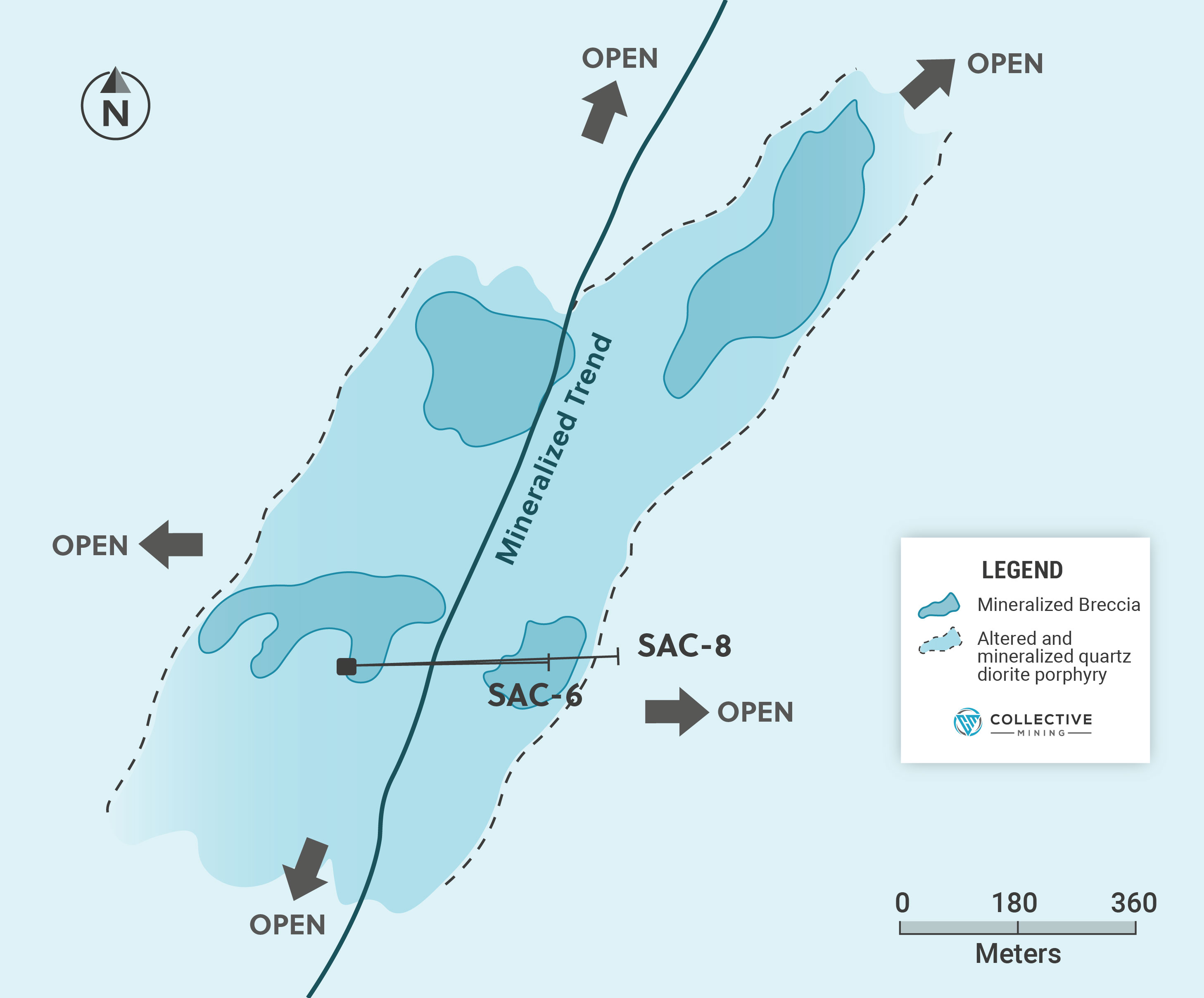

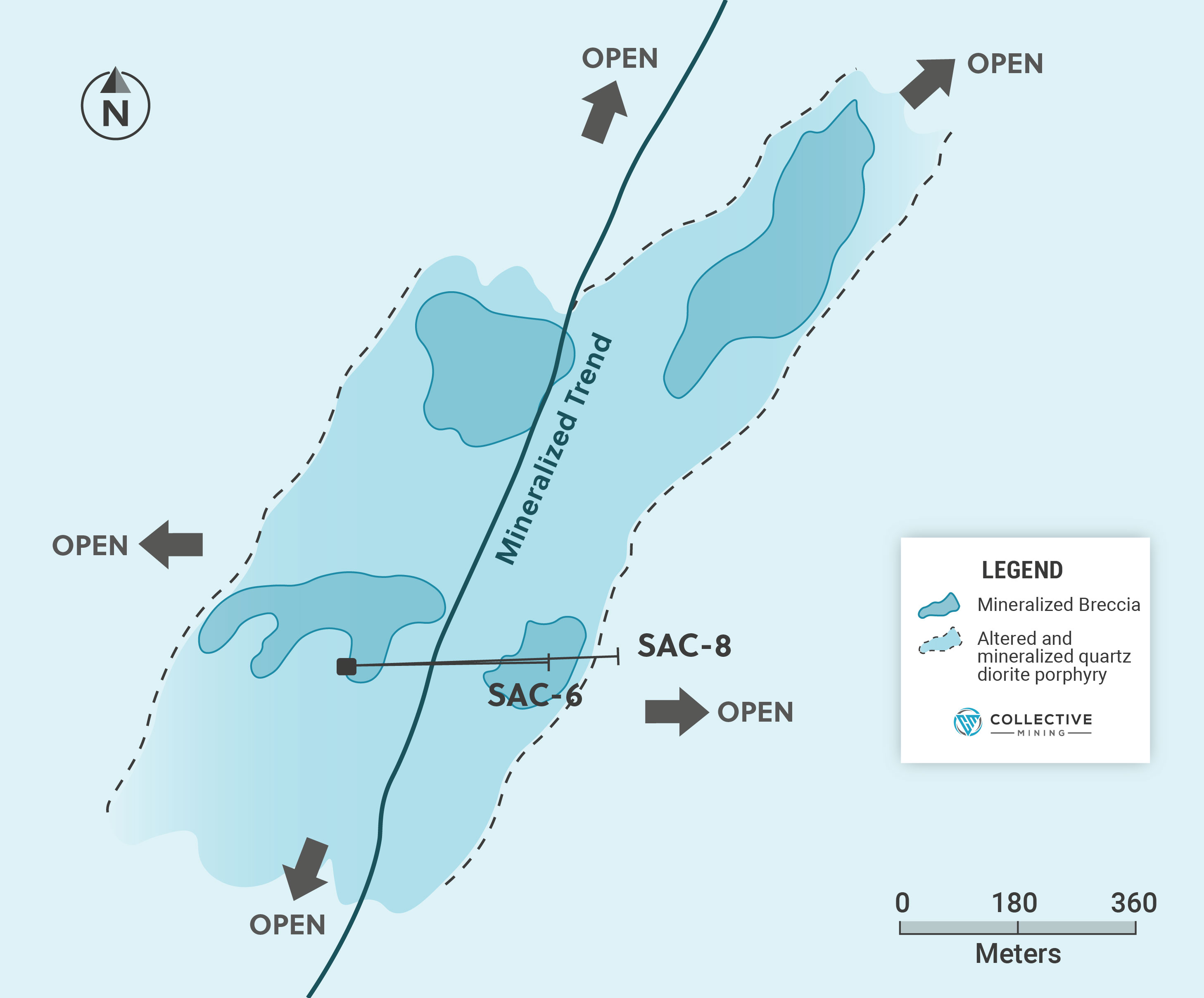

PLAN VIEW OF THE POUND TARGET

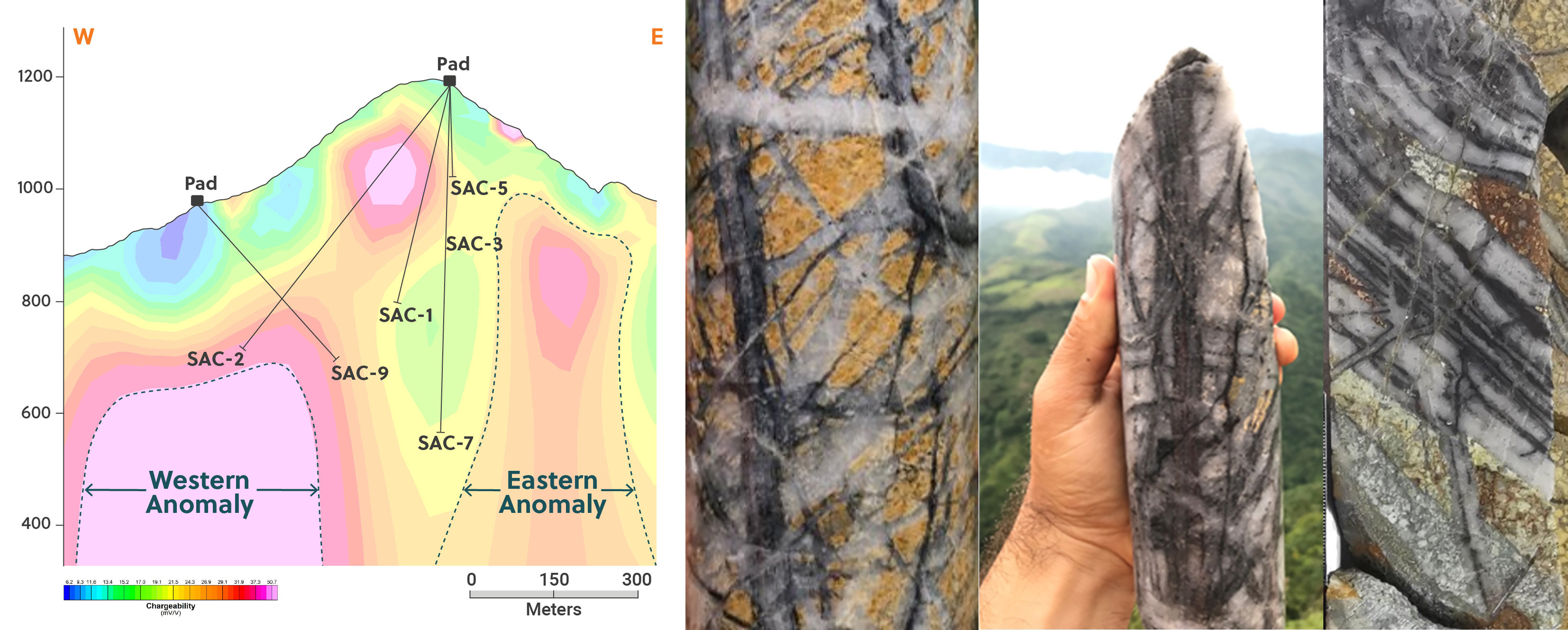

The Pound target is a significant grassroots discovery made from surface, in October, 2021. The target is located in the northern portion of the project, is defined by multiple hydrothermal breccia bodies hosted within highly altered diorite and quartz diorite, and overprinted by late stage, polymetallic veins. This zone of altered intrusive and breccia bodies trends NE-SW and has as strike length of 1.3 kilometres. The zone remains open in all directions.

A phase 1 drill program was completed in 2021 with two significant, 700+ metre intercepts of mineralization from surface encountered in each hole. The breccia body remains open in all directions and a phase 2 drill program is planned for 2023.

| Hole # |

From (m) |

To (m) |

Intercept (m) |

Au (g/t) |

Ag (g/t) |

Cu% |

Mo % |

AuEq (g/t)* |

| SAC-6 |

- |

750.40 |

750.40 |

0.32 |

6 |

0.02 |

0.001 |

0.41 |

| Incl. |

59.80 |

246.55 |

186.75 |

0.50 |

9 |

- |

- |

0.59 |

| and |

680.85 |

750.40 |

69.55 |

0.41 |

2 |

0.12 |

0.009 |

0.65 |

| SAC-8 |

- |

710.05 |

710.05 |

0.40 |

6 |

0.04 |

0.001 |

0.53 |

| Incl. |

3.50 |

155.70 |

152.20 |

0.50 |

11 |

0.01 |

0.000 |

0.62 |

| and |

469.80 |

603.10 |

133.30 |

0.61 |

6 |

0.15 |

0.003 |

0.92 |

*Please click here to view links to prior press releases for metrics used for equivalent calculations