- Four directional holes drilled into the Apollo Porphyry System (“Apollo”) have expanded the wireframed envelope to the southwest, intercepted high-grade mineralization at the deepest vertical depth drilled to date and improved upon the grade profile below 1,500 metres elevation in a sparsely drilled area.

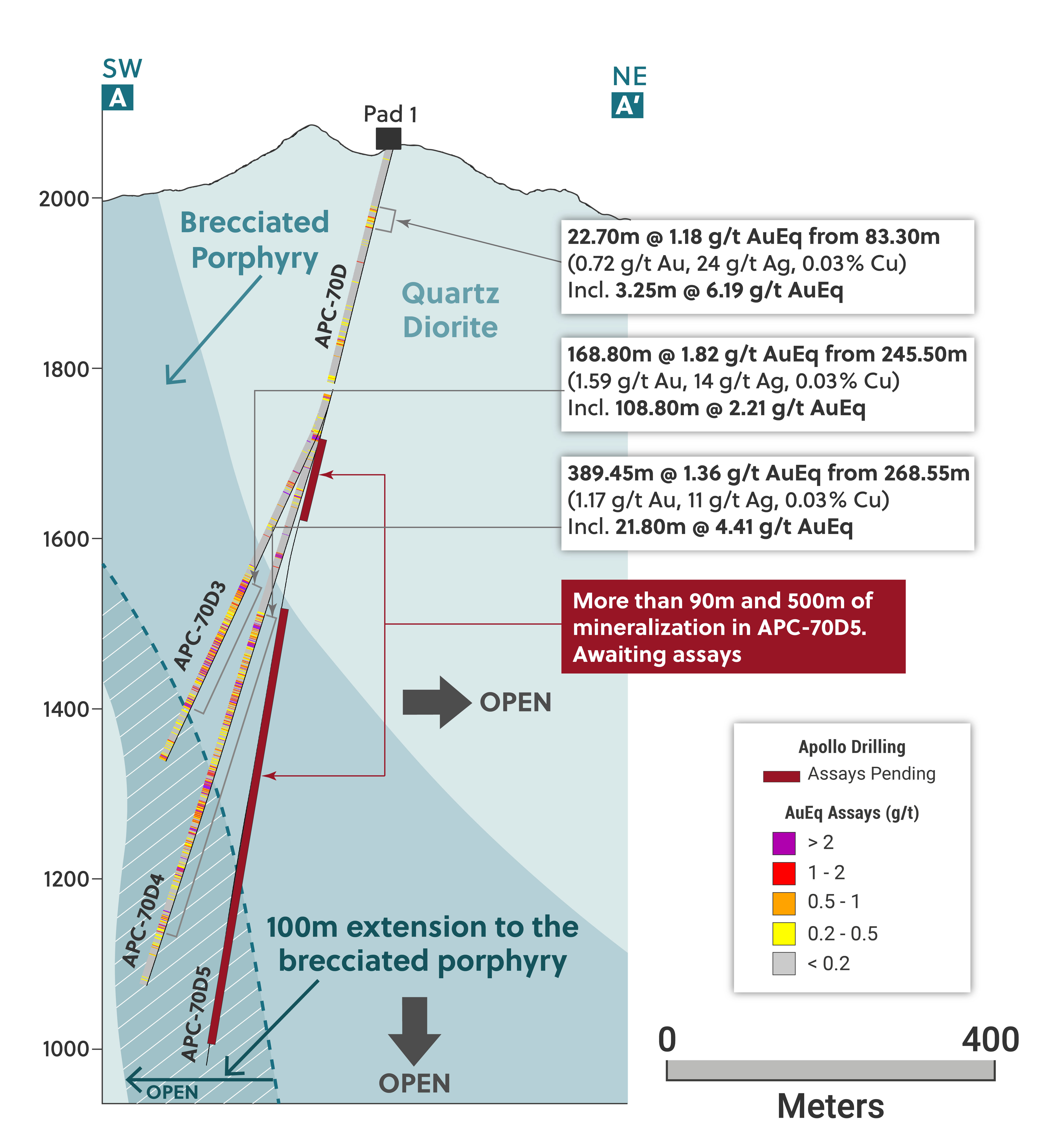

- APC70-D4 intersected 389.45 metres @ 1.36 g/t gold equivalent up to 935 metres below surface with the final 21.8 metres of this intercept grading 4.41 g/t gold equivalent. APC70-D4 has locally extended the system by 100 metres to the southwest and intercepted the deepest mineralization ever encountered at Apollo.

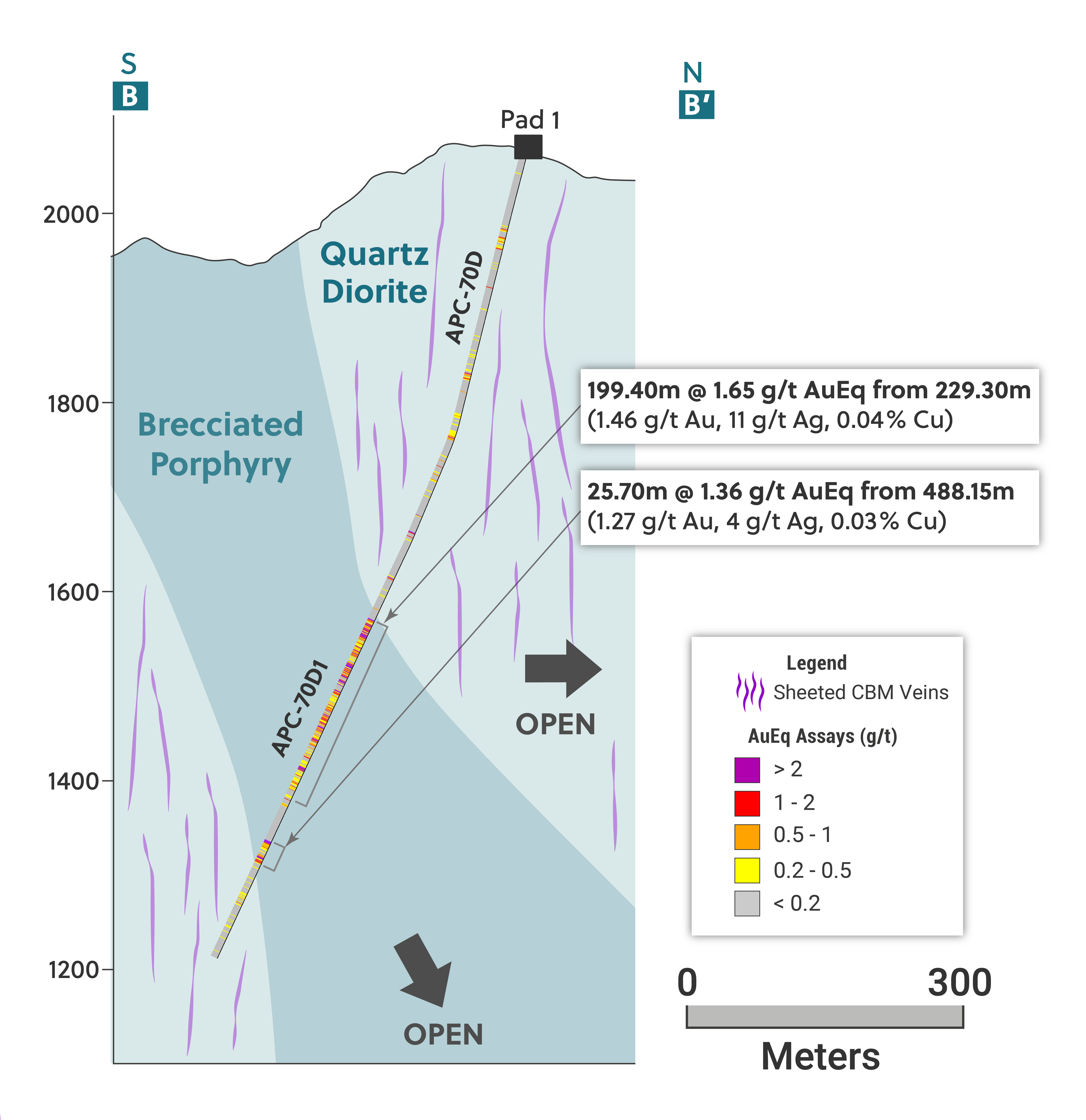

- APC70-D1, which was drilled to the south across the Apollo system at a near true angle, intersected 199.40 metres @ 1.65 g/t gold equivalent, including 26.5 metres @ 3.48 g/t gold equivalent to a maximum vertical depth of 745 metres below surface.

- APC70-D2, which was drilled to the southeast also at a near true angle to the Apollo system, intersected 168.20 metres @ 1.32 g/t gold equivalent, including 21.35 metres @ 3.11 g/t gold equivalent to a maximum vertical depth of 625 metres below surface.

- APC70-D3, which was drilled to the southwest, intersected 168.80 metres @ 1.82 g/t gold equivalent to a maximum vertical depth of 654 metres below surface. The hole bottomed while still in mineralization with the final 4.70 metres grading 1.40 g/t gold equivalent indicating potential for further expansion of the mineralized envelope.

- Visual logging of recently completed directional drill hole APC70-D5 and APC88-D1 have intercepted a potential expansion at depth for Apollo as well as a new porphyry unit located north of Apollo under the Olympus system. Assay results for both holes are expected in January.

- Drilling continues at the Guayabales project with four rigs, two operating at the Apollo and Trap targets respectively and a backlog of assay results expected in the near future.

Ari Sussman, Executive Chairman commented: “Our directional drill program is off to an excellent start by demonstrating that orthogonal drilling improves the grade profile locally due to an abundance of zones flooded with mineralized CBM vein fluid. Additionally, directional drilling is making it much easier for the Company to test and expand the Apollo envelope by allowing the Company to quickly reach areas that are not possible to drill from surface due to topography. Visual observations of holes APC70-D5 (Pad 1) and APC88-D1 (Pad 14) notes intercepts of more than 500 metres (APC70-D5) and 500 metres plus a second zone of more than 200 metres (APC-88-D1) indicating that a potential material size increase to the envelope of the system will be forthcoming upon receipt of assays in early Q1, 2024.”

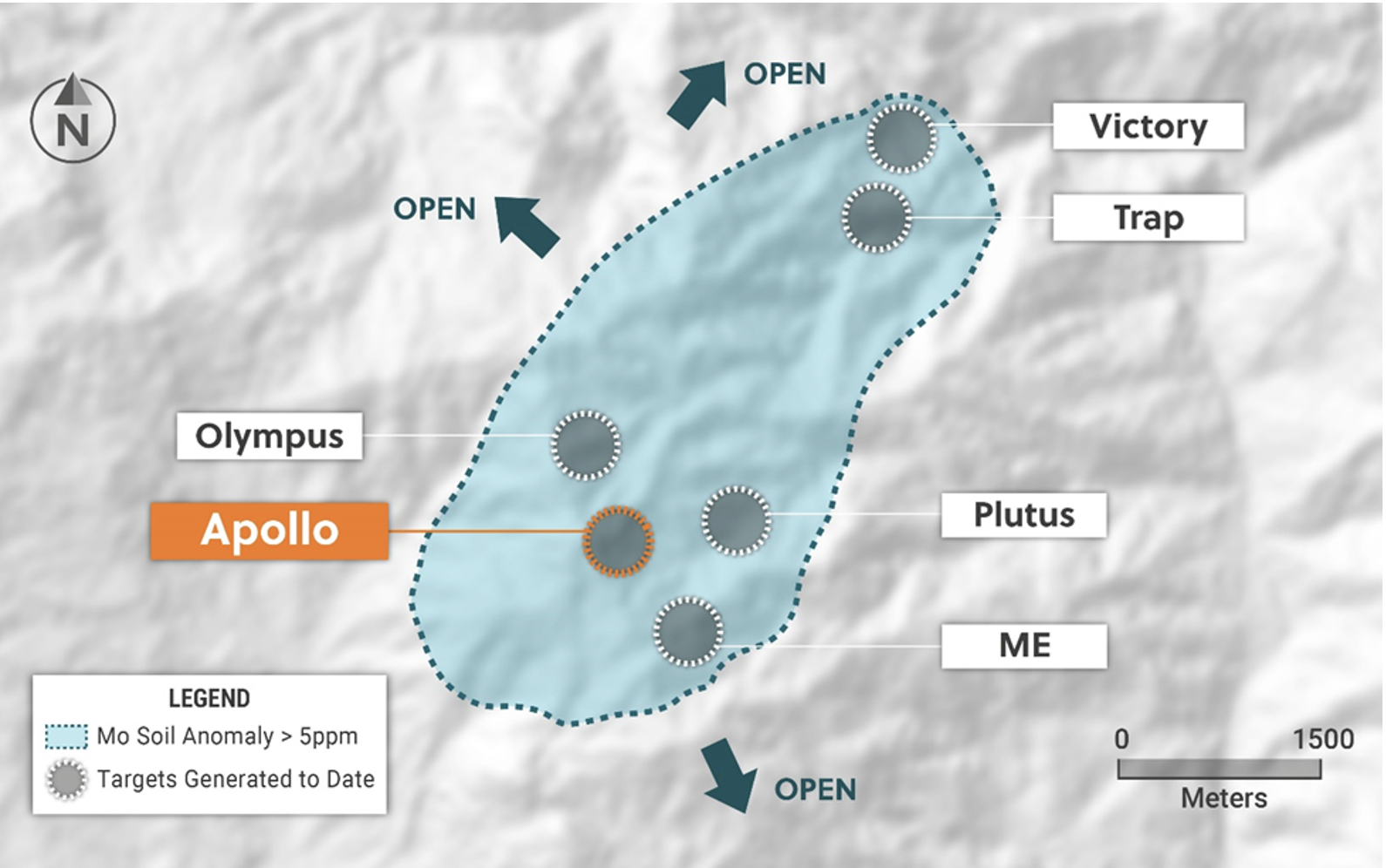

Toronto, Ontario, December 11, 2023 - Collective Mining Ltd. (TSX: CNL, OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results from the first four directional drill holes into the Apollo porphyry system (“Apollo”). Apollo hosts an outcropping high-grade, bulk tonnage gold-silver-copper-tungsten porphyry system measuring 520 metres x 395 metres x 935 metres (previously 915 metres) which remains open for further expansion. Presently there are four diamond drill rigs operating at the Guayabales project as part of the Company’s planned 42,000 metre drilling program for 2023.

Details (See Table 1 and Figures 1-5)

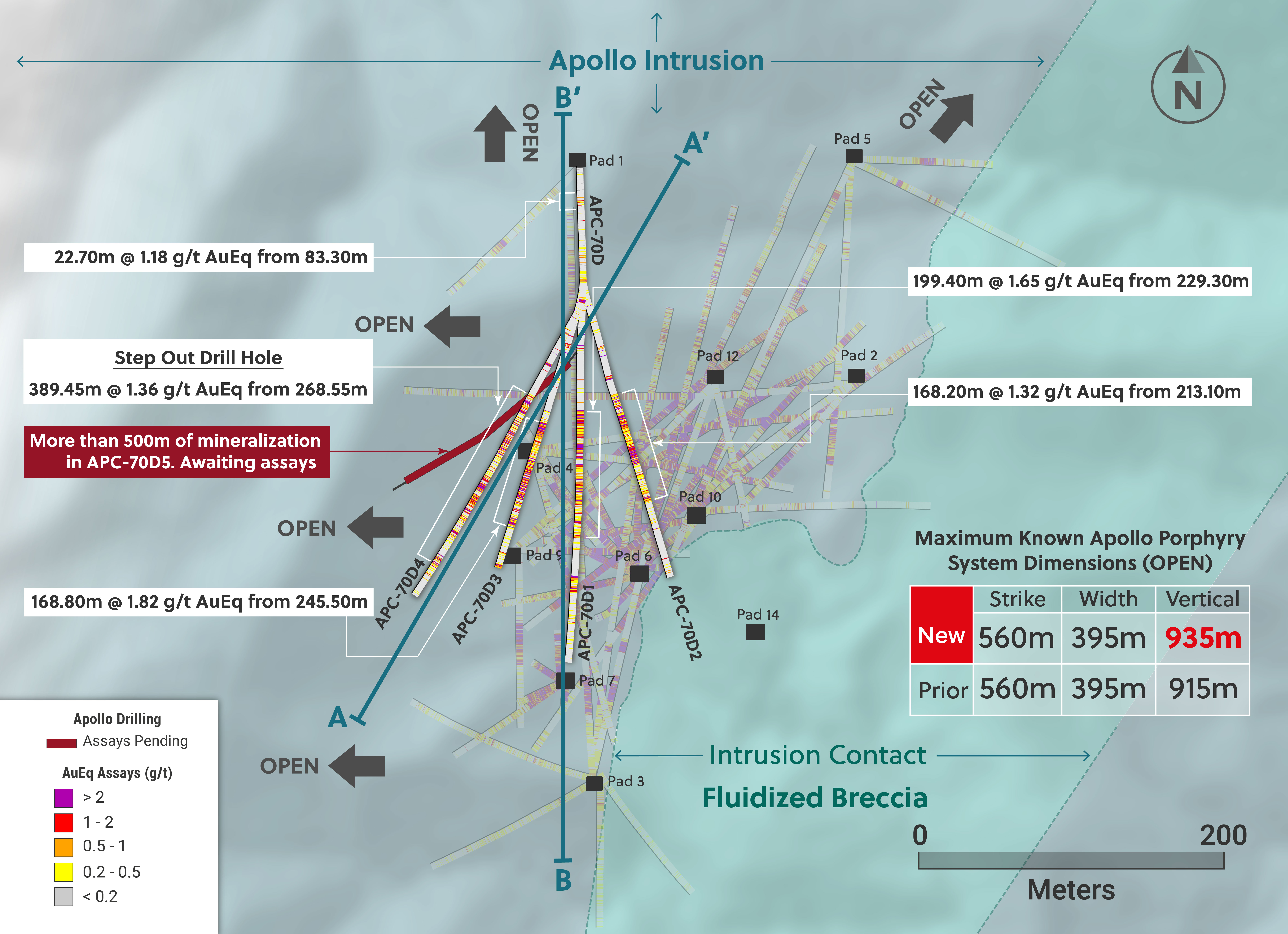

This press release outlines the first results from the mother hole (APC-70) and four directional holes (APC70-D1 to D4) drilled from the end of the mother hole and designed to test for grade continuity at depth as well as western extensions to the Apollo porphyry system. APC-70 was drilled due south from Pad 1 and its directional holes form a fan pattern from southeast to southwest, intersecting the Apollo system more perpendicularly than prior drilling.

APC-70 was the mother hole for this first directional program and was drilled steeply to the south from Pad 1 to a final downhole depth of 293.30 metres. The principal objective of this hole was to reach the optimal depth to commence the directional drillholes. The hole intersected shallow mineralization related to carbonate and base metal (“CBM”) veining at 83.30 metres downhole for 22.70 metres with assays results as follows:

- 22.70 metres @ 1.18 g/t gold equivalent from 83.30 metres downhole.

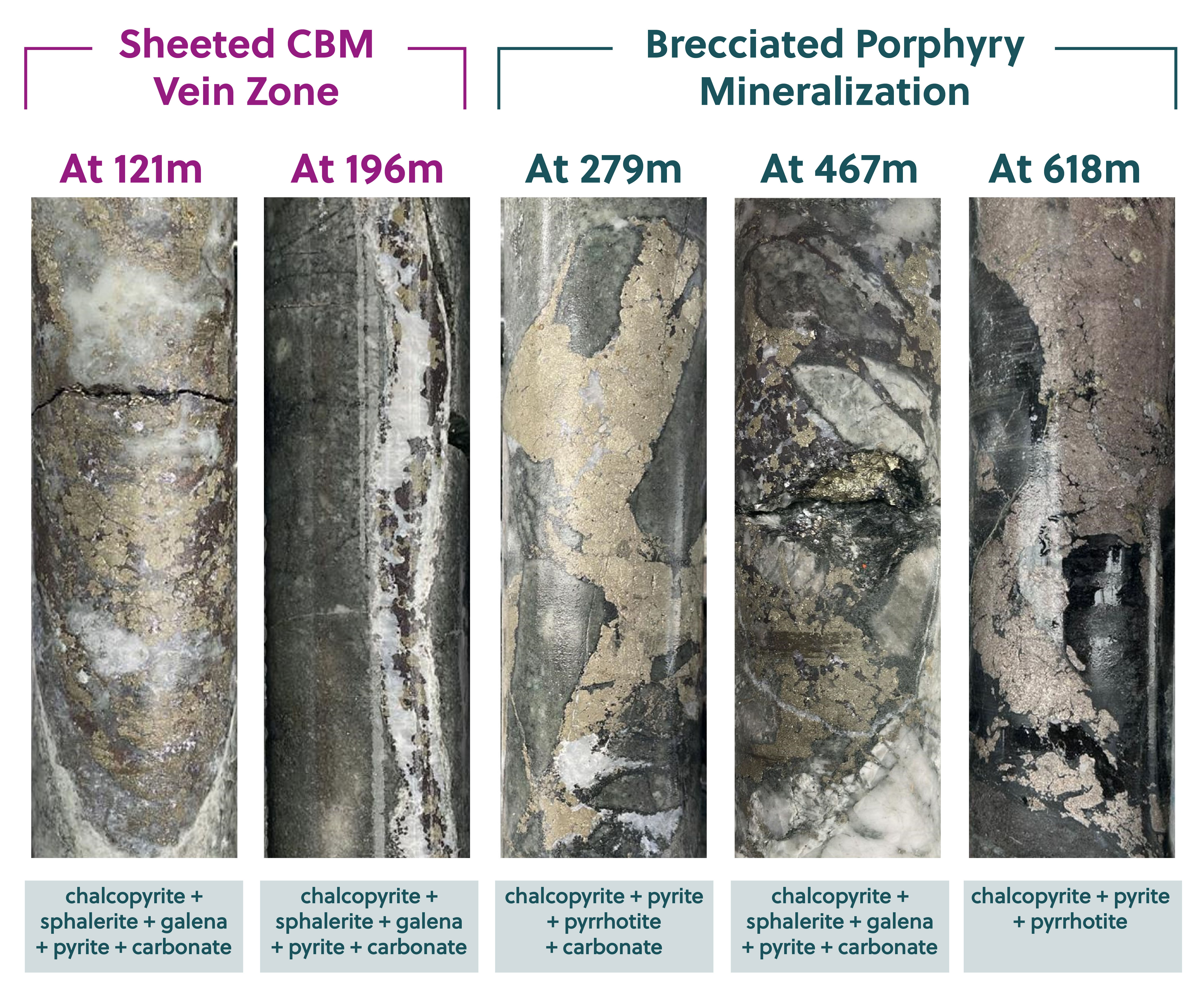

APC70-D1 was the first deflection from the mother hole and was drilled due south to a final directional downhole depth of 624.10 metres (745 metres vertical from surface due to depth of mother hole). The hole entered brecciated porphyry at 229.30 metres downhole and continued in mineralization for 199.40 metres. The mineralized breccia zone consists of a sulphide matrix cement hosting chalcopyrite (up to 0.4%), pyrite (up to 1.6%) and pyrrhotite (up to 0.8%) as well as later and overprinting CBM vein sulphides such as sphalerite (up to 0.8%), galena (up to 0.3%) and trace amounts of fine, free gold with assay results as follows:

- 199.40 metres @ 1.65 g/t gold equivalent from 229.30 metres downhole (consisting of 1.46 g/t gold, 11 g/t silver and 0.04% copper) including:

- 32.90 metres @ 2.32 g/t gold equivalent from 281.40 metres downhole and;

- 26.50 metres @ 3.48 g/t gold equivalent from 402.20 metres downhole.

APC70-D1 encountered better grades than previously modelled in this area from drill holes APC-17 and APC-49 and as a result will improve the grade block model in this location. Directional drilling perpendicular to the breccia body has also identified multiple zones of sheeted CBM veins which were intersected from downhole depths of 229.30 metres, 281.40 metres and 402.2 metres over intersection lengths ranging from 22.3 metres to 32.90 metres with grades between 2.32 g/t gold equivalent to 3.48 g/t gold equivalent.

APC70-D2 was drilled in a southeast direction from the mother hole to a maximum downhole deflection depth of 501.80 metres (625 metres vertical from surface due to depth of mother hole). The hole encountered sheeted CBM vein zones at 15.00 metres and 181.40 metres downhole depths for intervals of 11.70 metres and 5.90 metres, with grades of 1.52 g/t gold equivalent and 1.78 g/t gold equivalent, respectively. The hole entered brecciated porphyry at 213.10 metres depth and intersected 168.20 metres of mineralization consisting of a sulphide cement matrix hosting chalcopyrite (up to 0.3%), pyrite (up to 1.5%) and pyrrhotite (up to 1.0%) with CBM vein sulphides such as sphalerite (up to 0.3%) and galena (up to 0.2%). The following assay results are highlighted:

- 11.70 metres @ 1.52 g/t gold equivalent from 15.00 metres downhole (consisting of 1.38 g/t gold, 10 g/t silver and 0.02% copper) and;

- 168.20 metres @ 1.32 g/t gold equivalent from 213.10 metres downhole (consisting of 1.14 g/t gold, 11 g/t silver and 0.03% copper) including:

- 21.35 metres @ 3.11 g/t gold equivalent from 240.00 metres downhole.

APC70-D2 also encountered better grades than previously modelled in this area due to the presence of multiple zones hosting sheeted CBM veins (see Table 1) and as a result will improve upon the grade block model in this location.

APC70-D3 was drilled southwest to a maximum directional depth of 481.10 metres (654 metres vertical from surface due depth of mother hole). At the beginning of the hole, sheeted CBM vein mineralization was intersected over intervals between 5.10 metres and 28.45 metres with grades of up to 3.33 g/t gold equivalent. Beginning at 245 metres downhole, brecciated porphyry mineralization was intercepted over a total of 168.80 metres. The sulphide mineralization in the breccia matrix in this interval consists of chalcopyrite (up to 0.3%), pyrite (up to 1.1%), sphalerite (up to 0.6%), galena (up to 0.8%) and pyrrhotite (up to 1.5%). The following assay results are highlighted:

- 168.80 metres @ 1.82 g/t gold equivalent from 245.50 metres downhole (consisting of 1.59 g/t gold, 14 g/t silver and 0.03% copper) including:

- 21.65 metres @ 2.27 g/t gold equivalent from 247.95 metres downhole and;

- 108.80 metres @ 2.21 g/t gold equivalent from 305.50 metres downhole.

The APC70-D3 intercept has extended the Apollo system locally for a further 25 metres to the southwest into an area with no previous drilling. Furthermore, the hole bottomed in mineralization with the final 4.7 metres grading 1.4 g/t gold equivalent, opening the opportunity for further mineralization extensions in this area.

APC70-D4 was drilled southwest to a maximum directional downhole depth of 728.25 metres (935 metres vertical from surface due to depth of mother hole). APC70-D4 is the deepest hole drilled to date at Apollo, reaching depths of 935 metres below surface (1,075 RL).

From 45.25 metres to 197.80 meters the hole encountered a series of sheeted CBM vein intervals hosted within quartz diorite porphyry. Beginning at 268.55 metres downhole, the hole intersected 389.45 metres of brecciated porphyry mineralization with sulphide matrix cement hosting chalcopyrite (up to 0.2%), pyrite (up to 3.0%), sphalerite (up to 0.5%), galena (up to 0.2%) and pyrrhotite (up to 1.3%). The following assay results are highlighted:

- 4.25 metres @ 14.35 g/t gold equivalent from 119.35 metres downhole (consisting of 13.87 g/t gold, 60 g/t silver and 0.02% copper) and;

- 389.45 metres @ 1.36 g/t gold equivalent from 268.55 metres downhole (consisting of 1.17 g/t gold, 11 g/t silver and 0.03% copper) including:

- 84.25 metres @ 1.88 g/t gold equivalent from 456.25 metres downhole and;

- 21.80 metres @ 4.41 g/t gold equivalent from 636.20 metres downhole.

The results of directional hole APC70-D4 confirm the discovery of a 100-metre southwest depth extension to the Apollo Porphyry system. Apollo remains open to the west for further expansion and recent visual logging of new, westerly directed, directional hole APC70-D5 has confirmed the discovery of over 500 metres of brecciated porphyry mineralization in this area.

Exploration Drill Program and Assay Update

Diamond drilling at the Guayabales project currently totals 128 drill holes (approximately 51,380 meters) completed and assayed. The 2023 Phase II drilling program is advancing on schedule with assay results reported for 57 holes and an additional ten holes awaiting assay results from the laboratory.

With four diamond drill rigs now operating at site, the Company is advancing with the following objectives:

- Expanding the Apollo porphyry system both laterally and vertically. The Company is currently advancing with directional drilling utilizing two rigs aimed at expanding the Apollo system to the north, west and at depth.

- Drill test the Trap target in the northern portion on the Guayabales project. Three widely spaced reconnaissance holes were completed at Trap in 2022 with the discovery hole, TRC-1 assaying 102.2 metres @ 1.53 g/t gold equivalent (see press release dated September 7, 2022) and containing similar mineralization to the Apollo porphyry system. Follow up drilling is now underway and initial assay results are expected in due course.

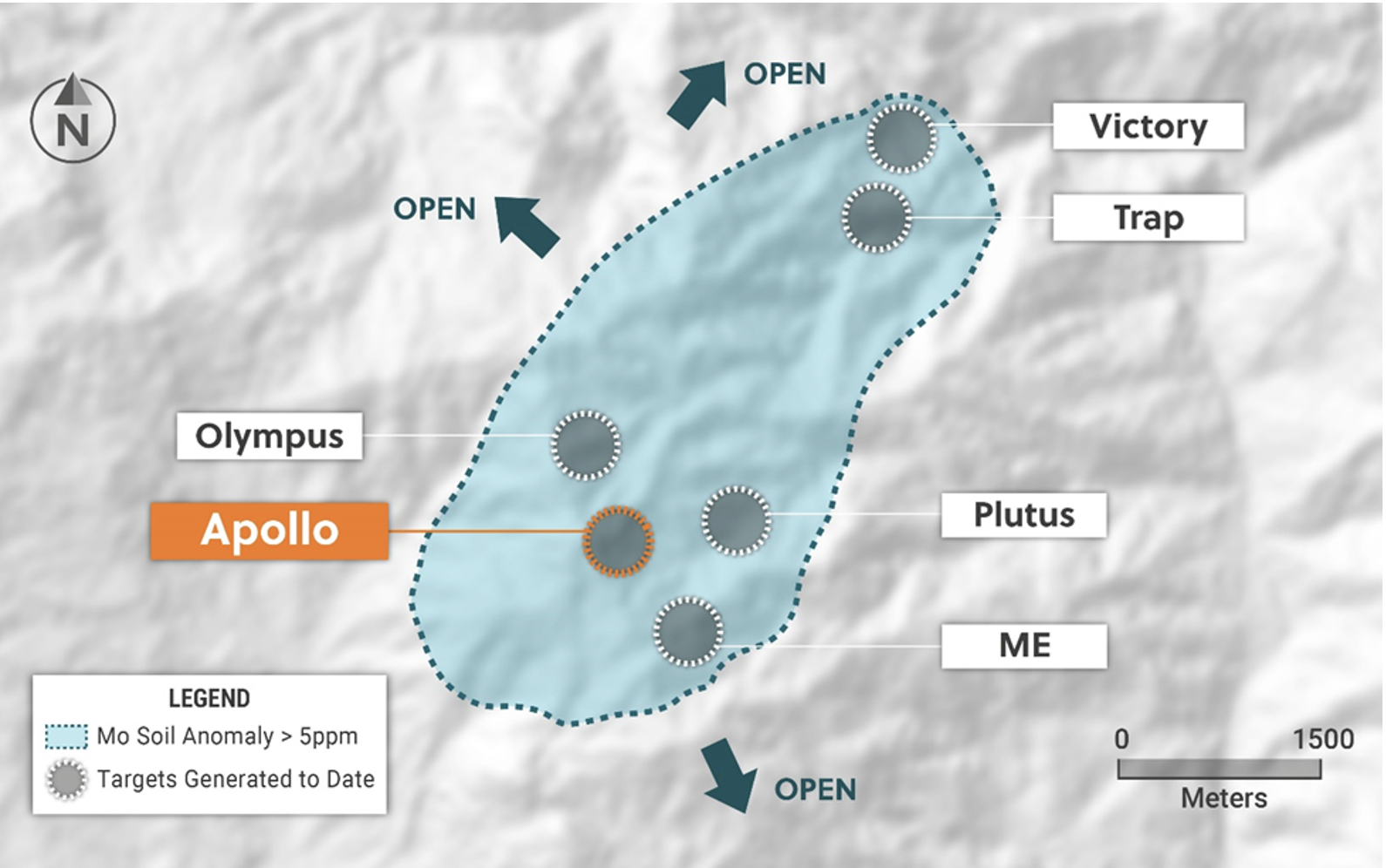

The Apollo area, as defined to date by surface mapping, rock sampling and copper and molybdenum soil geochemistry covers a 1,000 metres X 1,200 metres area and represents a large and unusually high-grade gold-silver-copper tungsten porphyry system. Mineralization styles include early-stage porphyry veins, inter-mineral brecciated porphyry mineralization and multiple zones of late stage, sheeted, carbonate-base metal veins with high gold and silver grades. The Apollo area is still expanding as the Company’s geologists have found multiple additional outcrop areas with porphyry veining, breccia, and late stage, sheeted, carbonate base metal veins. (See press release dated April 18, 2023)

Table 1: Assay Results for APC-70, APC70-D1, APC70-D2, APC70-D3 and APC70-D4

| Hole # |

From

(m) |

To

(m) |

Length

(m) |

Au

g/t |

Ag

g/t |

Cu

% |

Mo

% |

WO3

% |

AuEq

g/t* |

| APC-70 |

83.30 |

106.00 |

22.70 |

0.71 |

23 |

0.03 |

0.008 |

- |

1.15 |

| Incl |

83.30 |

86.55 |

3.25 |

4.78 |

104 |

0.03 |

0.002 |

- |

6.19 |

| APC70-D1 |

229.30 |

428.70 |

199.40 |

1.46 |

11 |

0.04 |

0.001 |

- |

1.65 |

| Incl |

229.30 |

251.60 |

22.30 |

1.82 |

31 |

0.08 |

0.002 |

- |

2.36 |

| and Incl |

281.40 |

314.30 |

32.90 |

2.17 |

11 |

0.03 |

0.002 |

- |

2.32 |

| and Incl |

341.10 |

372.90 |

31.80 |

1.67 |

9 |

0.03 |

0.001 |

- |

1.81 |

| and Incl |

402.20 |

428.70 |

26.50 |

3.41 |

7 |

0.04 |

0.001 |

- |

3.48 |

| and |

488.15 |

513.85 |

25.70 |

1.27 |

4 |

0.03 |

0.004 |

- |

1.36 |

| APC70-D2 |

15.00 |

26.70 |

11.70 |

1.38 |

10 |

0.02 |

0.000 |

- |

1.52 |

| and |

181.40 |

187.30 |

5.90 |

1.25 |

34 |

0.04 |

0.000 |

- |

1.77 |

| and |

213.10 |

381.30 |

168.20 |

1.14 |

11 |

0.03 |

0.001 |

- |

1.32 |

| Incl |

240.00 |

261.35 |

21.35 |

2.83 |

20 |

0.04 |

0.001 |

- |

3.10 |

| and incl |

296.90 |

324.20 |

27.30 |

2.32 |

16 |

0.04 |

0.001 |

- |

2.55 |

| and incl |

366.00 |

381.30 |

15.30 |

1.44 |

10 |

0.05 |

0.001 |

- |

1.64 |

| APC70-D3 |

7.45 |

12.55 |

5.10 |

3.23 |

11 |

0.02 |

0.000 |

- |

3.33 |

| and |

106.45 |

134.90 |

28.45 |

0.48 |

6 |

0.01 |

0.000 |

- |

0.58 |

| and |

245.50 |

414.30 |

168.80 |

1.59 |

14 |

0.03 |

0.002 |

- |

1.82 |

| Incl |

247.95 |

269.60 |

21.65 |

1.79 |

30 |

0.06 |

0.001 |

- |

2.27 |

| and Incl |

305.50 |

414.30 |

108.80 |

2.00 |

14 |

0.03 |

0.002 |

- |

2.21 |

| and |

476.40 |

481.10 |

4.70 |

0.99 |

28 |

0.01 |

0.002 |

- |

1.40 |

| APC70-D4 |

45.25 |

51.30 |

6.05 |

1.90 |

35 |

0.10 |

0.002 |

- |

2.52 |

| and |

119.35 |

123.60 |

4.25 |

13.87 |

60 |

0.02 |

0.000 |

- |

14.34 |

| and |

192.00 |

197.80 |

5.80 |

5.35 |

19 |

0.02 |

0.000 |

- |

5.50 |

| and |

268.55 |

658.00 |

389.45 |

1.17 |

11 |

0.03 |

0.001 |

- |

1.36 |

| Incl |

279.20 |

308.45 |

29.25 |

2.18 |

30 |

0.05 |

0.000 |

- |

2.62 |

| and Incl |

456.25 |

540.50 |

84.25 |

1.64 |

16 |

0.03 |

0.001 |

- |

1.88 |

| and Incl |

579.90 |

592.25 |

12.35 |

1.70 |

14 |

0.03 |

0.001 |

- |

1.92 |

| and Incl |

636.20 |

658.00 |

21.80 |

4.40 |

8 |

0.02 |

0.000 |

- |

4.41 |

**AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag (g/t) x 0.016 x 0.88) + (Cu (%) x 1.79 x 0.90)+ (Mo (%)*11.62 x 0.85) + (WO3 (%)*6.54 x 0.50) utilizing metal prices of Cu – US$3.85/lb, Ag – US$24/oz Mo - US$25/lb, WO3 - US$31,000/t and Au – US$1,475/oz and recovery rates of 97% for Au, 88% for Ag, 85% for Mo, 50% for WO3 and 90% for Cu. Recovery rate assumptions for gold are based on metallurgical results announced on October 17, 2023. Recovery rates for copper, molybdenum, tungsten and silver are speculative as limited metallurgical work has been completed to date on these metals. True widths are unknown, and grades are uncut. All depths outlined in directional holes are from commencement of kick off point in the mother hole.

Figure 1: Plan View of APC-70, APC70-D1, APC70-D2, APC70-D3 and APC70-D4

Figure 2: Cross Section Highlighting Holes APC70-D3, APC70-D4 and APC70-D5

Figure 3: Cross Section Highlighting Hole APC70-D1

Figure 4: Core Photo Highlights of APC70-D4

Figure 5: Plan View of the Guayabales Project Highlighting the Apollo Target Area

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a gold, silver, copper and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade gold-silver-copper-tungsten Apollo porphyry system. The Company’s near-term objective is to continue to expand the overall dimensions of the system, which remains open in most directions and test newly generated grassroots targets.

Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSX under the trading symbol "CNL" and on the OTCQX under the trading symbol “CNLMF”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples have been prepared and analyzed at SGS and ALS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) and Collective Mining (@CollectiveMini1) on Twitter.

Investors and Media

Paul Begin, Chief Financial Officer

[email protected]

+1 (416) 451-2727

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking information and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking information. In this news release, forward-looking information relate, among other things, to: anticipated advancement of mineral properties or programs; future operations; future recovery metal recovery rates; future growth potential of Collective; and future development plans.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others: risks related to the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; conclusions of future economic evaluations; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, precious and base metals or certain other commodities; fluctuations in currency markets; change in national and local government, legislation, taxation, controls regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formation pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties, as well as those risk factors discussed or referred to in the annual information form of the Company dated April 7, 2022. Forward-looking information contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and there may be other factors that cause results not to be anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information.